Extract from Law 6/2023, of 22 November, of the Generalitat Valenciana, in

in relation to Inheritance and Gift Tax.

-99% rebate on the portion of the tax liability of the

Inheritance and gift tax, with effect from 28 May

2023, for the goods and rights declared by the taxable person in:

(a) Acquisitions mortis causa made by relatives of the

causal persons belonging to groups I and II of Article 20(2).

(a): descendants and adoptees, spouses, ascendants, and

adopters.

(b) inter vivos acquisitions made by the spouse,

parents, adoptive parents, children or adopted children of the donor, grandchildren, and

grandparents.

In order to qualify for this rebate, the purchase must be

is made in a public document.

In the same way, and in relation to inter vivos transfers, to

effects of the application of the reduction of €100,000 on the base

The taxable amount of the tax has been abolished:

(a) The limit of having a pre-existing asset of up to

600.000€.

b) The previous 10-year limit, but the limitation is maintained.

donations from the same

donor, carried out within the 5 years immediately preceding

above.

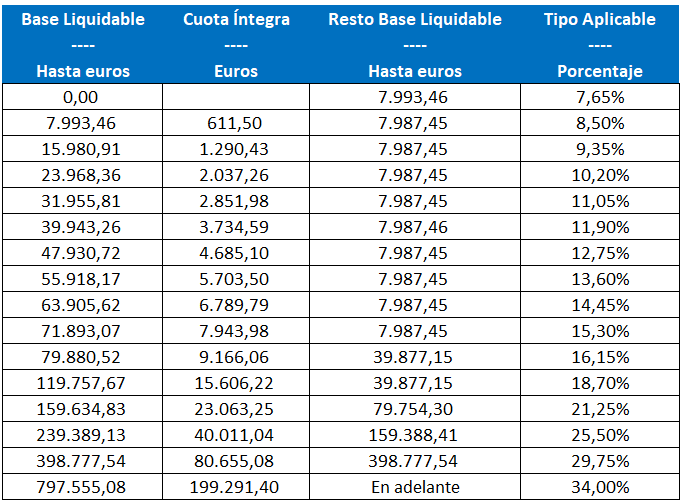

-Inheritance and gift tax rate for the financial year

2024: